Diligently checking the crypto markets on a daily—or perhaps hourly—basis: it’s an adrenaline rush, but is it the most efficient way to trade? If efficiency is your goal, algorithmic cryptocurrency trading bots can help.

What are crypto trading bots?

Cryptocurrency trading bots are computer programs that create and submit buy and sell orders to exchanges based on the rules of a pre-defined trading strategy. For example, a very simple trading bot might be programmed to sell ETH when the crypto’s price reached a certain threshold.

In short, crypto trading bots enable trading based on data and trends—not on emotional impulse. Ultimately, this usually grows their profits, minimizes their risks, and limits their losses across exchanges. Furthermore, bots can produce passive income 24 hours a day. Whether you’re sleeping, biking, giving a presentation, whatever: you could also be earning from automated trades.

Automated trading is supported by a growing number of platforms, but we’ve done the research and presented our favorites below, along with some practical context and advice about making them work for you.

Common crypto bot trading strategies:

Arbitrage bots

An arbitrage bot is a computer program that examines and compares coin prices across exchanges in order to make automated trades that take advantage of price discrepancies. For example a bitcoin arbitrage bot might identify that BTC is trading for $200 more per token on Kraken than it is on bitFlyer, leading the bot to buy BTC on bitFlyer and quickly sell it on Kraken in order to make a small profit.

Grid bots

A grid bot is simple and good for beginners. You simply set multiple “grids” of upper and lower cost limits for a certain cryptocurrency. The bot then makes a series of interchangeable trades in order to incrementally accumulate profit. Let’s say you had the following parameters for COMP:

Lower limit: $1,000

Upper limit: $2,000

Grid quantity: 10

If the price of COMP is at $1,500 when you program the bot, you will have 4 open orders for sell and 5 open orders for buy. If the price increases to $1,600, the bot will automatically place two paired orders: sell at $1,600 and buy at $1,500. The $100 profit is added to your balance.

Sandwich bots

Sandwich bots detect when a trader is placing a bid on a token. They then place a higher bid on the same token. The bot is betting that the trader will still want the token, so if it wins the token, it will immediately try to sell it to the original bidder at a higher price than the coin would initially have sold for.

Best bot for beginner traders: GTAI Trading Bot

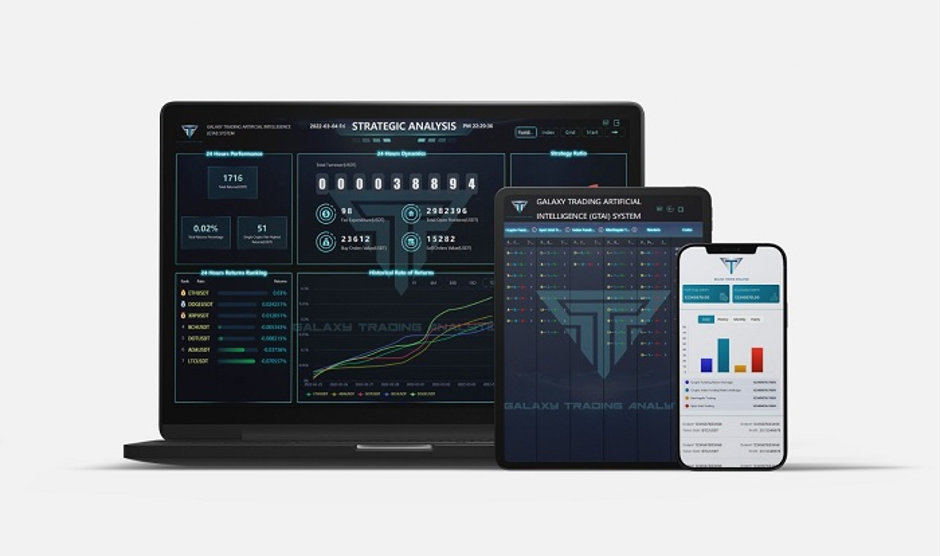

Galaxy Trading Artificial Intelligence (GTAI) is a world-class AI trading plus arbitrage system designed to help crypto traders maximize trading profits while minimizing risks and losses. Galaxy Trading Analytics (GTA), the leading regulated Fintech company founded in 2022 by a team of AI and Deep Learning experts that created the Bot. They have constructed a clear and transparent system that conducts trading transactions according to the parameters set, and have connected investment tools and financial protection algorithms to it. There are currently 4 proprietary trading and arbitrage strategies implemented, with more trading strategies that are currently being developed and will be added to GTAI once more stringent tests are being done.

Traders can also go for Package B, where traders will get access to a dedicated team to monitor their trading on their behalf, deploying the right strategies according to the market movement. There will also be active risk management in place, 24 hours a day. Package B also grants access to higher leverage using liquidity pools, which means higher and more consistent profits by more powerful AI bot, going between 3% to 36% monthly gains. Both options can be selected at the same time, they are suitable for beginners, advanced or expert traders, and participation start from as low as $100.

Best bot for Python programmers: Trality

What sets Trality apart is its powerful Python API, which lets traders use this familiar language and libraries to develop bots. Its in-browser coding features include intelligent autocomplete and backtesting, debugging, and soon, rebalancing. This bot has been slower than some others to introduce new features and exchanges, but its easy-to-use Python integration and detailed documentation make complex bot building more transparent.

Best for coders: Gunbot

Gunbot isn’t especially easy to use, but it’s full of features—if you’re willing to get over the learning curve. This tool’s price reflects that it’s a tool for advanced traders, particularly those who are comfortable coding their own scripts. It works differently than most bots: it’s’ a one-time purchase of a software download. This means that it’s security depends on you, and also that you can resell the license if you’re not satisfied or stop using it. Best for coders: Gunbot has an active community for support and pre-built scripts.